Small Business Loans for Barbadians

Small businesses are a vital part of the Barbadian economy and to Bajans themselves. We get our food, electronics, clothes, furniture and more from our brothers and sisters, who bravely start their own hustle. However, the biggest problem many of us face when we start a small businesses is funding. While many of us look for a job to finance our businesses until they are self sufficient, some may prefer a loan. So let’s talk about where you can source small business loans. Let’s make dreams come true.

Things you should know before applying for small business loans.

When you are ready to apply for your small business loan, you need to know a few basic things. You should know how to register your business in Barbados and the type of loan you are getting, whether the loan secured or unsecured. Let’s briefly discuss this.

Registering your business

Most, if not all lenders require that your business is registered in Barbados, in order to qualify for a loan. So let’s talk about how you do that.

Online Registration

First, visit the Corporate Affairs and Intellectual Property Offices (CAIPO) website. Head over to the Forms & Documents tab. Under the ‘Forms for Online Registration’ title, click Business Names Forms. Download the Form of Application for Registration. Fill out the document and sign it.

Second, sign up for EZpay and pay the fee for registration, through this website. This the payment portal for government affiliated bodies. After the payment has been made, download the receipt.

TAKE NOTE! You can simply input your information and pay as normal if you have a credit card. However, if you use a debit card, you must download an authorization form from the EZpay website, fill it out, have it stamped by your bank and submit it to CAIPO in order to pay online.

Finally, submit the signed application form and receipt along with a copy your national ID via email to caipo.general@barbados.gov.bb.

In Person Registration

On the other hand, you can visit CAIPO at the Baobab Towers in Warrens, St. Michael and register in person there. Just speak to the guard at the entrance and they will guide you to the correct office.

Definition: Secured Loans

According to Investopedia, a secured loan is a business or personal loan that requires collateral as a condition of borrowing. Collateral may include, property, vehicles and other assets. This decreases the interest rates for borrowers, since they are a lower risk to lenders. Read more here.

Definition: Unsecured Loans

According to Investopedia, an unsecured loan is a loan that does not require the submission of collateral from the borrower. The loan is given based simply on the borrowers creditworthiness. The loans often carry a higher interest rate since it is riskier on the lender. Read more here.

Now, let’s talk about your loan options!

Trust Loans

The Barbados Trust Fund Limited was opened by the Right Honourable Dwight Sutherland in 2018. According to their website, they have disbursed more than 3000 loans a value of $13,681,442.46. If you want to apply for a loan here, your business must be registered. Apply online through this link or contact them directly for more information. You can call them at +1 (246) 228-3275 or email them info@trustloansbb.com.

Fund Access

The Barbados Agency for Micro Enterprise Development Ltd. is a financing agency for small businesses. They have existed since January 2, 1998.

They offer loans under 5 categories. These include the Business Boost, Business Escalator, Business Innovator, Business Facilitator and Business Pro. Each loan carries different requirements, which can be found on the website, as well as loan calculators which can give you an estimate of you will pay. To contact them, call +1 (246) 228-1366 or email info@fundaccess.org.

Barbados Worker’s Union

BWU offers a few services for small business owners to use. For instance, BWU offers financial seminars, networking meetings and access to an business directory. In addition, they provide small business loans. You can choose from their SMART Micro package, their SMART Business loans or use any other developmental and start up loans they offer.

Contact them via email at info@bwuccu.com or call +1(246) 436-5600. To communicate specifically with the loans department email loans@bwuccu.com. You can also WhatsApp them!

See their Contact Us page for more details.

Barbados Public Worker’s Co-operative Credit Union

BPWCCUL offers micro business loans as advertised on their website. Once your loan is approved, you will be able to access workshop training and networking opportunities to help you and your business grow. For a free consultation call 622-9000. To apply, visit their branch or click this link to find the form. It is in the loans category of the list.

You can email them at contact@bpwccul.bb or visit their Contact Us page for more details.

City of Bridgetown Credit Union

COB offers small business loans as well. Unfortunately, as of March 2021, this information is not currently on their website. Nevertheless, you can still apply. Your business must have existed for 3+ years and application can be done online through any of their loans pages, as reported by a customer service representative.

If you click the the application form under each loan, you will find that the document is the same.

It is suggested that you give them a call at +1 (246) 430-5900 before applying or visit the branch for further information. Also, you can visit a branch to start the process in person. Email them at info@cobcreditunion.com or visit their Contact Us page for more details,

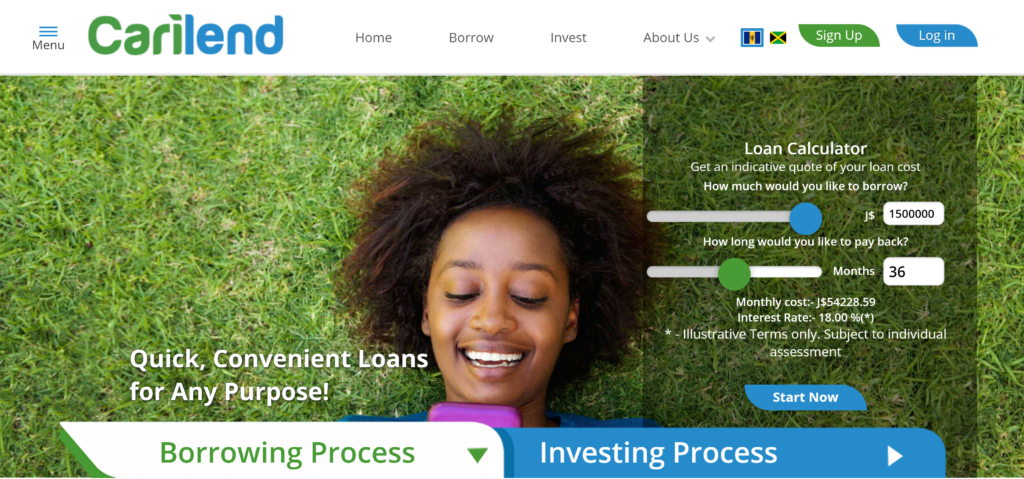

Carilend

This 4 year old internet company is a quick and easy way to land an unsecured loan. If you’re interested, head on over to their website to check out their loan calculator. Using this easy tool, you can find out how much your monthly repayments would be if you borrowed your desired amount of funds for a predetermined time.

For more information, you can visit their social media or simply visit their website. Contact them via phone at +1 (246) 537 4040 or email at info@carilend.com. Visit their Contact Us page for more details.

If you are simply ready to apply, click here! But remember to do your research first.

Barbados Youth Business Trust

The Barbados Youth Business trust is a great option for sourcing financing. They offer loans and grants for small businesses. They are specifically for businesses that are 5 years and younger. For further information, check out their website, where they describe the general requirements and regulations. The application forms are at the bottom of the page as well!

In addition, the Barbados Youth Business Trust offers mentoring, personal development, marketing and promotion, networking and more.

Contact them via phone at +1 (246) 228-2772, or email at info@youthbusiness.bb. You can also register using this link.

More information on attaining small business loans

The Barbados Investment and Development Corporation (BIDC) offers an article with an in depth explanation of government incentives and funding options for small businesses.

This article is especially important to read, if your business is in the manufacturing, tourism or agriculture sectors. You will find grants, insurance benefits and credit facilities that you can apply for. See this list for more details.

- Special Technical Assistance Programme

- Export Credit Insurance Scheme

- Enhanced Credit Guarantee Scheme

- Export Finance Guarantee Scheme

- Export Rediscount Facility

- Barbados Investment Fund

- Tourism and Manufacturing Guarantee Facility (formerly Small Business Guarantee Scheme)

- Industrial Credit Fund Technical Assistance Grant

- Small Hotels of Barbados Inc.

- Tourism Loan Fund

- Agricultural Development Fund

- Industrial Investment and Employment Fund

- Innovation Fund

In addition, the Small Business Association also discusses these and other financing opportunities that Barbadians have. It is an easy read and worth your while. Click here for more details.

Small Business Development Act

As a small business owner, reading through the Small Business Development Act would be an excellent investment of your time. This gives you an idea how the laws of Barbados affect your business. Subsequently, you can make plans to take advantage of incentives and funding offered, as your business grows from 1 customer to thousands.

Click here for direct access to the file.

Figure out which small business loans are the best for you!

Seeking finance for your micro or small business can be a challenging feat. Putting together your business plan, registering your business, balancing your books and filling out tedious forms are a nightmare for those who hate paperwork. However, your start-up capital and equipment financing is important for you to stabilize your business.

Be sure to research carefully and ask questions before committing to many major financial decisions. Use the internet, including credible websites like Investopedia to understand business and finance terms. Ask your loans officer to explain terms and policies you don’t understand as many times as necessary, until you are confident that you have absorbed the information. Reach out to those who have applied for business loans before and listen to their experiences. Educate yourself, then take your first steps to realizing your dreams.

Remember, Barbados has many opportunities, including those listed above and more that can help your dreams come true.

Are you looking for a job to finance your business instead of getting a loan? Click here.

Responses